One could indeed argue that shares have run too far this year and that a phase of consolidation would make sense, as the company's business growth has to catch up to the massive 50% share price increase in H1 alone. If the analyst community is right, then NVIDIA will not generate compelling returns over the next year. The current consensus price target by the analyst community is $750, thus shares do seem rather expensive. Even in 2021, which saw some growth stocks underperform, NVIDIA has done very well so far, as its shares rose by around 50% during the first half.Īt $815 per share, NVIDIA is currently trading just a couple of percentage points below its all-time high. Over the last ten years, NVIDIA saw its shares deliver an incredible 4,900% return, turning a $10,000 investment into $500,000. NVIDIA Corporation has been one of the best performers in recent years, as the company saw its share price explode upwards due to a combination of fast growth, crypto mining tailwinds, a PC gaming boom that is great for NVIDIA's GPU segment, and the market's admiration for growth stocks: Data by YCharts To some degree, the premium seems justified due to NVIDIA's strong growth outlook. We see that NVIDIA is currently trading at a steep premium compared to many of its peers, while also offering a dividend yield that is well below the average. For long-term oriented investors, NVIDIA could be a solid investment, although waiting for a correction to get a more favorable entry price could pay off.

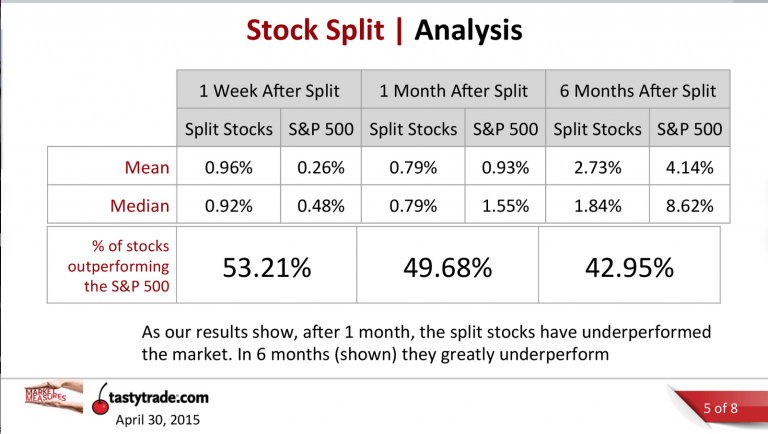

NVIDIA's shares are expensive, but on the other hand, the company is growing fast and has a lot of room for growth in the coming years. Other companies, such as Apple ( AAPL) and Tesla ( TSLA) have seen their shares do well following stock splits last year, but I still don't think it's a good idea to buy solely due to an announced stock split. NVIDIA Corporation ( NASDAQ: NVDA) announced a stock split that will go into effect on July 20.

Dilok Klaisataporn/iStock via Getty Images Article Thesis

0 kommentar(er)

0 kommentar(er)